AI-powered digital asset management transforms compliance from reactive to proactive for regulated industries.

- Faster MLR review cycles through automated compliance checking and predictive metadata

- Enhanced regulatory alignment with DSCSA, DORA, and EU AI Act requirements

- Streamlined audit processes using intelligent workflows and real-time tracking capabilities

- Reduced compliance operational overhead for organizations implementing comprehensive DAM strategies

Organizations using modern DAM for pharma and financial services are turning compliance from a bottleneck into a competitive advantage.

Every life sciences and financial organization faces the same mounting challenge: how to balance the exponentially growing volume of content that needs rapid market deployment with rigorous compliance requirements that ensure regulatory adherence and minimize risk. This is precisely why digital asset management for regulated industries has become essential for sustainable growth.

The ability to distribute content globally at an accelerated pace while maintaining brand consistency and regulatory appropriateness has become essential for business success. However, in 2025, businesses must accomplish this more effectively and efficiently, navigating an increasingly complex regulatory landscape that includes new requirements like the Digital Operational Resilience Act (DORA) for financial services and enhanced Drug Supply Chain Security Act (DSCSA) compliance for pharmaceuticals.

Digital asset management becomes critical for regulated industries seeking sustainable compliance and operational excellence.

What Are the Key Compliance Challenges That Make Digital Asset Management for Regulated Industries Essential?

Professionals working within stringent regulatory environments face unprecedented challenges as compliance requirements continue to evolve. The global regulatory compliance market is expected to reach $32.93 billion by 2029, reflecting the increasing complexity organizations must navigate.

Pharmaceutical companies must comply with medical, legal, and regulatory requirements before publicly distributing any content. Without proper compliance asset management, updates slip through review processes, causing non-compliant assets to reach distribution and incur penalties from regulatory agencies. These oversights can cost organizations significantly, with regulatory violations carrying substantial financial penalties.

Financial institutions face similar pressures with evolving data protection regulations and enhanced scrutiny around digital asset security. The new DORA requirements, fully operational since December 2024, mandate comprehensive operational resilience frameworks that directly impact how financial organizations manage and protect their digital assets. Modern financial DAM tools are specifically designed to address these regulatory complexities while maintaining operational efficiency.

Beyond regulatory penalties, compliance failures negatively impact consumer trust. Customers depend on pharmaceutical companies and financial institutions to provide clear, accurate information that directly affects their health and financial wellbeing.

How Does AI-Powered DAM Transform Compliance Management in 2025?

The integration of artificial intelligence into digital asset management represents a paradigm shift from reactive to proactive compliance management. AI-powered DAM systems are delivering measurable improvements in compliance efficiency, with organizations cutting asset retrieval times by 40% and significantly reducing manual oversight requirements.

Modern DAM platforms utilize machine learning algorithms to automatically categorize assets based on compliance requirements, regulatory jurisdiction, and content type. This intelligent categorization ensures that pharmaceutical marketing materials automatically receive appropriate MLR routing, while financial documents are flagged for relevant regulatory review processes.

AI content detection capabilities have become particularly valuable for regulated industries. These systems can automatically identify when assets require specific disclaimers, compliance statements, or regulatory approvals. For pharmaceutical companies, this means automatically flagging any patient-facing materials that require FDA review, while financial institutions can ensure all customer communications meet SEC disclosure requirements.

What New Regulatory Requirements Are Reshaping DAM Strategies?

The regulatory landscape of 2025 introduces several key compliance frameworks that directly impact how organizations must manage their digital assets. Understanding these requirements is essential for implementing effective compliance asset management strategies.

The Drug Supply Chain Security Act (DSCSA) continues its phased implementation, with new requirements for pharmaceutical tracking and serialization affecting how companies manage product-related digital assets. Organizations must ensure that all promotional materials, labeling, and educational content maintain accurate product identifiers and supply chain information.

Financial services organizations must now navigate the Digital Operational Resilience Act, which establishes comprehensive requirements for digital operational resilience. This regulation directly impacts how financial institutions manage their digital assets, requiring enhanced monitoring, testing, and third-party risk management protocols.

The EU AI Act, fully operational in 2025, introduces specific requirements for organizations using AI in content creation and management. Companies must implement governance frameworks that ensure AI-generated content meets regulatory standards while maintaining transparency in automated decision-making processes.

These evolving requirements highlight the importance of implementing comprehensive digital asset management for regulated industries that can adapt to regulatory changes while maintaining operational efficiency.

How Can Organizations Streamline MLR and Compliance Review Processes?

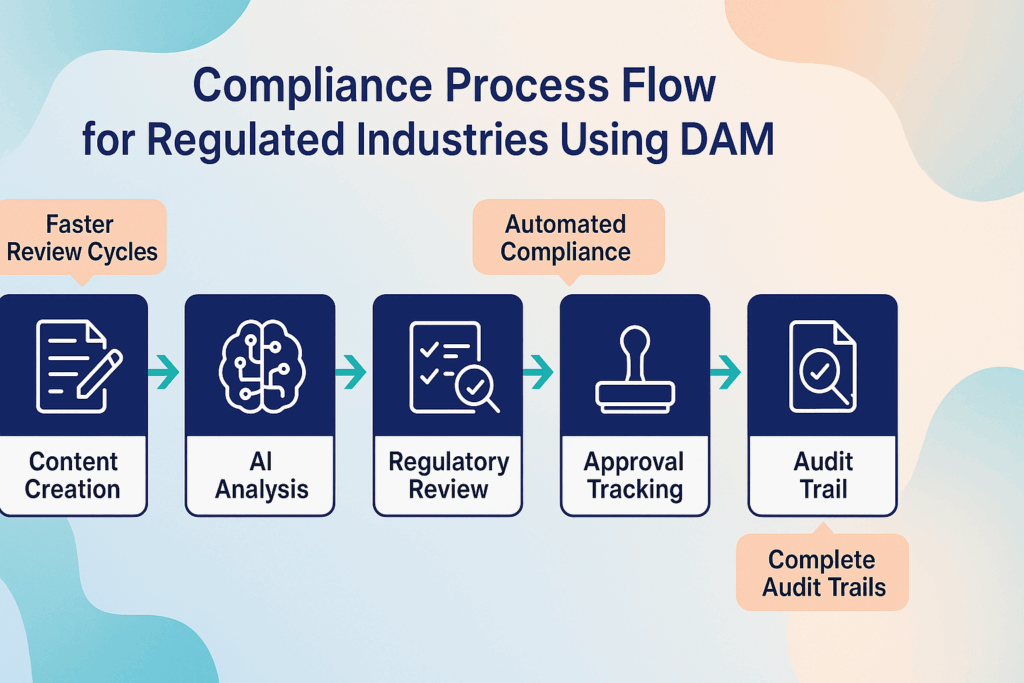

Building upon traditional MLR approaches, modern digital asset management systems revolutionize how organizations handle medical, legal, and regulatory reviews. The key lies in integrating compliance requirements directly into content creation workflows rather than treating them as separate approval processes.

Start with intelligent concept review.

Advanced DAM platforms enable stakeholders to collaborate on content concepts before full development begins. AI-powered systems can analyze initial briefs against regulatory databases to identify potential compliance issues early in the creative process.

Implement automated compliance routing.

Modern DAM for pharma includes intelligent workflow automation that routes content to appropriate reviewers based on content type, therapeutic area, and intended usage. The system automatically applies relevant compliance checklists and ensures no required approvals are bypassed.

Utilize AI-powered content analysis.

Automated compliance checking can identify potential regulatory risks before human review, allowing MLR teams to focus on strategic compliance decisions rather than routine flagging. These systems learn from previous review outcomes to improve accuracy over time.

Establish version control with compliance tracking.

Every revision, approval, and modification is automatically tracked with detailed audit trails. Comprehensive tracking ensures organizations can quickly respond to regulatory inquiries and demonstrate compliance during audits.

Organizations implementing these streamlined approaches report significant efficiency gains, with leading pharmaceutical companies achieving substantial reductions in manual review time while maintaining rigorous compliance standards.

What Does an MLR Reviewer Need to Evaluate in 2025?

The role of MLR reviewers has evolved with the introduction of AI-powered assistance and enhanced regulatory requirements. When evaluating content in 2025, reviewers analyze materials from six critical perspectives, building upon traditional approaches with new technological capabilities.

- Editorial accuracy remains fundamental but now includes verification of AI-generated content accuracy. Reviewers must ensure numbers, statements, and formatting meet current standards while validating that any AI-assisted content generation maintains factual precision.

- Conceptual alignment evaluates whether the overall theme resonates with current therapeutic understanding and regulatory guidance. This includes assessing whether content aligns with recent FDA guidance updates or new clinical evidence.

- Risk assessment has expanded to include AI-related compliance risks. Reviewers must evaluate whether content poses organizational risk while ensuring compliance with evolving AI transparency requirements under new regulatory frameworks.

- Brand and message consistency verification ensures content aligns with approved brand personas and previously validated messaging. Advanced DAM systems assist this process by automatically flagging content that deviates from established brand guidelines.

- Contextual appropriateness evaluation considers audience relevance and platform suitability, including assessment of how modular content components work within larger campaigns or digital experiences.

- Regulatory currency represents a new evaluation category, ensuring content reflects the most current regulatory environment and compliance requirements, particularly important given the rapid pace of regulatory updates in 2025.

How Do Leading Organizations Achieve Compliance Excellence?

Real-world implementations demonstrate the transformative impact of modern compliance asset management across regulated industries. These success stories highlight specific strategies and measurable outcomes that organizations can replicate.

Pharmaceutical Success: Enhanced MLR Efficiency

Leading pharmaceutical organizations are implementing AI-powered DAM systems to manage MLR processes across multiple countries. These implementations focus on automated compliance flagging, predictive metadata application, and intelligent workflow routing based on content type and geographic requirements.

Organizations report that AI-powered content analysis eliminates substantial manual review time annually, allowing MLR professionals to focus on strategic compliance decisions rather than routine content flagging.

Financial Services Achievement: Streamlined Compliance Reporting

Regional banks are leveraging automated asset tracking and audit trail generation to enhance SEC compliance reporting. These implementations reduce audit preparation time while improving documentation accuracy and eliminating previous gaps in regulatory oversight. Advanced financial DAM tools are proving particularly effective for managing customer communications, investment disclosures, and regulatory submissions across multiple jurisdictions.

Insurance Industry Innovation: Multi-Jurisdictional Compliance

Multi-state insurers utilize DAM to manage regulatory compliance across different state requirements. Advanced systems automatically apply appropriate disclaimers and regulatory language based on geographic distribution, substantially reducing compliance errors while accelerating campaign deployment.

These organizations share common implementation strategies: comprehensive compliance workflow automation, intelligent content categorization, and proactive regulatory change management.

How Should Organizations Select DAM Systems for Regulatory Compliance?

Selecting the right digital asset management platform for regulated industries requires careful evaluation of compliance-specific capabilities alongside traditional DAM functionality. Organizations must prioritize solutions that address their unique regulatory environment while providing scalability for future requirements.

Regulatory certification and security standards form the foundation of any compliance-focused DAM evaluation. Look for platforms with relevant industry certifications such as FedRAMP for government contractors, HIPAA compliance for healthcare organizations, or SOC 2 Type II certification for financial services.

AI-powered compliance automation capabilities distinguish leading platforms from basic asset storage solutions. Evaluate systems that offer automated compliance flagging, intelligent workflow routing, and predictive metadata generation specifically designed for your regulatory requirements.

Integration ecosystem compatibility ensures seamless operation within existing compliance infrastructure. Your chosen platform should integrate with current quality management systems, regulatory databases, and audit tools without disrupting established workflows. Financial institutions should select financial DAM tools that seamlessly connect with existing risk management systems and regulatory reporting platforms.

Audit trail comprehensiveness must meet regulatory documentation requirements. Every asset interaction, modification, and approval should be automatically tracked with timestamps, user identification, and detailed change logs.

Scalability and future-proofing considerations include the platform’s ability to adapt to changing regulatory requirements and accommodate organizational growth. Look for vendors with demonstrated experience in regulatory compliance and a track record of adapting to new requirements.

Before finalizing any DAM selection, organizations should request detailed compliance documentation and reference implementations from similar regulated organizations.

What Measurable Benefits Do Organizations Achieve?

When companies successfully implement comprehensive digital asset management for regulated industries, they realize substantial, measurable benefits that surpass basic compliance adherence. These outcomes demonstrate a clear return on investment while improving operational efficiency.

Transparency and audit readiness emerge as immediate benefits, with organizations reporting significantly faster response times to regulatory inquiries. Comprehensive audit trails and automated documentation eliminate the scramble typically associated with compliance audits, allowing teams to focus on strategic initiatives rather than reactive compliance management.

Financial accountability and cost reduction manifest through eliminated redundancies and improved resource allocation. Organizations typically see substantial reductions in compliance-related operational costs through automated workflows and reduced manual oversight requirements.

Enhanced audit and inquiry support capabilities enable organizations to respond to regulatory requests within hours rather than weeks. Detailed tracking of asset usage, modifications, and approvals provides regulators with immediate access to required documentation.

Comprehensive digital rights management ensures appropriate usage permissions while protecting intellectual property. This capability proves valuable for pharmaceutical companies managing licensed content and financial institutions handling proprietary research and analysis.

Streamlined re-review processes automatically trigger when content approaches expiration or when regulatory requirements change. This proactive approach prevents the costly consequences of using outdated or non-compliant materials in market-facing communications.

How Is AI Reshaping Compliance in Regulated Industries?

The integration of artificial intelligence into compliance asset management represents the most significant advancement in regulatory technology in decades. Organizations leveraging AI-powered DAM systems are transforming compliance from a constraint into a competitive advantage.

Automated compliance checking utilizes machine learning algorithms trained on regulatory databases and historical approval patterns. These systems can identify potential compliance issues before human review, streamlining the approval process while ensuring comprehensive regulatory coverage.

Intelligent content lifecycle management automatically tracks content from creation through expiration, sending proactive alerts when materials approach regulatory deadlines or when new requirements affect existing assets.

Predictive risk assessment analyzes content against current regulatory trends and upcoming requirement changes. Organizations receive early warnings about potential compliance issues, allowing proactive remediation rather than reactive corrections.

Natural language processing capabilities enable automated analysis of regulatory updates and guidance documents, automatically flagging existing content that may be affected by new requirements. Organizations can maintain compliance even as regulations change.

The most advanced implementations integrate AI compliance tools with broader business intelligence systems, providing executives with real-time visibility into compliance status across all content operations.

What Role Does Integration Play in Compliance Success?

Successful compliance asset management requires seamless integration between DAM systems and existing organizational infrastructure. The most effective implementations treat DAM as the central hub of a comprehensive compliance ecosystem rather than an isolated solution.

Quality management system integration ensures that content approval workflows align with established quality processes. For pharmaceutical organizations, this means direct integration with existing MLR tracking systems and regulatory databases.

Customer relationship management connectivity enables compliance tracking of customer-facing communications while ensuring all touchpoints maintain regulatory adherence. Financial services benefit from this integration for managing client communications and disclosure requirements.

Enterprise resource planning synchronization provides real-time visibility into compliance status across all business operations. This integration proves essential for organizations managing complex product portfolios with varying regulatory requirements.

Regulatory database connections enable automatic updates when compliance requirements change, ensuring content remains current with evolving regulations. Leading organizations establish direct feeds from FDA, SEC, and other relevant regulatory sources.

The key to successful integration lies in selecting DAM platforms designed specifically for regulated environments rather than attempting to retrofit general-purpose solutions for compliance requirements.

What Does the Future Hold for Regulated DAM?

Looking ahead, digital asset management for regulated industries will continue evolving toward even greater automation and intelligence.

Blockchain integration for compliance verification is emerging as a powerful tool for ensuring content authenticity and maintaining tamper-proof audit trails. Early adopters in pharmaceutical and financial services are piloting blockchain-verified content chains for critical regulatory submissions.

Advanced AI compliance modeling will provide organizations with predictive capabilities that anticipate regulatory changes and automatically adjust content accordingly. These systems will learn from regulatory patterns and organizational approval histories to continuously optimize compliance processes.

Enhanced personalization capabilities will enable organizations to deliver compliant, targeted content at scale while maintaining regulatory adherence across diverse markets and customer segments.

Frequently Asked Questions

How does DAM software specifically help pharmaceutical companies with FDA compliance? DAM software expedites FDA approval processes by automatically routing patient-facing materials through appropriate MLR workflows, tracking regulatory approvals with detailed audit trails, and flagging content that requires FDA review based on therapeutic area and content type. AI-powered systems can automatically apply required disclaimers and ensure all promotional materials meet current FDA guidance.

What specific compliance benefits do financial institutions gain from DAM implementation? Financial institutions achieve streamlined SEC compliance reporting, automated audit trail generation for regulatory inquiries, enhanced data protection through encryption and access controls, and automated application of required disclosures for customer communications. DAM systems also facilitate DORA compliance through comprehensive digital asset monitoring and third-party risk management capabilities.

How do modern DAM systems handle international regulatory variations? Advanced DAM platforms include geographic compliance modules that automatically apply appropriate regulatory requirements based on content distribution territories. Systems can manage varying disclosure requirements, language regulations, and approval processes across different countries while maintaining centralized oversight and audit capabilities.

What ROI can organizations expect from compliance-focused DAM implementation? Organizations typically achieve faster review cycles, substantial reduction in manual compliance tasks, and significant annual savings in compliance-related costs. Additional benefits include dramatically faster audit response times and accelerated compliant campaign deployment.

How do AI-powered DAM systems ensure accuracy in automated compliance checking? AI systems are trained on extensive regulatory databases and learn from historical approval patterns within each organization. They achieve high accuracy rates by continuously updating their knowledge base with new regulatory guidance and refining their algorithms based on reviewer feedback and approval outcomes.

The organizations that thrive will embrace technology not just for basic compliance but as a strategic enabler of business growth and customer engagement.Ready to transform your compliance operations from reactive to proactive? Aprimo’s intelligent content operations platform delivers the AI-powered compliance capabilities regulated industries need to succeed in 2025 and beyond.